Budget 2019

The City is exploring options to support the business community and sustain long-term economic health for all Calgarians. Source: City of Calgary

One of the least prominent but most significant financial management moves that Calgary City Council has made since 2010 is undertake the transitions from annual budgeting, to multi-year budgeting, and from business planning to service planning. These shifts have allowed us to better align our annual spend to our strategic goals as well as pursue savings and drive value. However, through the last four years of downturn, the tax shift has been a pernicious problem that wasn’t going away. After our $6 0million emergency mid-year cut last spring to protect protect small businesses, followed by a Provincial budget that significantly withdrew support and downloaded responsibilities, Council had to roll up its sleeves and effectively treat year two of our four year service plan and budget as a brand new year one.

And so starting at 9:30 in the morning of Monday, November 25 with a full day and evening of submissions from the public, and extending through the week with a service-by-service review followed by extensive debate, Council had crafted and passed a significantly altered budget by 6:30 in the evening on the Friday. I had entered the budget week deeply concerned that too many of my colleagues had accepted the tacit direction from the Province to cut, cut, cut.

As I have written, I 100% believe that this is the absolute wrong move given our economic environment and our imperative to finally and actually diversify our economy - our City Government is beautifully positioned to act counter-cyclically and use the downturn to cost-effectively keep sectors of our economy employed as well as build things to help us become the resilient City we need to become. I was very pleased with how Council has achieved keeping our cost increases below growth plus inflation over the past four years, and with the exception of our emergency $60 million cut, I wanted to treat the budget this year as a disciplined opportunity to do more of the same. The fact is that we pay extremely low taxes in Calgary for a great level of service - especially on the residential side of the roll - and I entered the Budget Week expecting to be in the small minority of Council willing to advocate for the politically unthinkable: raise taxes on residents to protect small businesses and maintain our high quality of services, particularly to protect the most vulnerable amongst us.

The Monday was an amazing day with the largest number of public submissions made in my ten years doing this job - perhaps surprisingly, the significant majority of diverse presenters argued for raising taxes to protect services. And throughout the week, while some members of Council were clearly about cutting, on every line item of substance, a different majority emerged supportive of the role those investments need to play in getting to Calgary’s best future. As the last item of the week, I was also amazed that a clear majority of Council had arrived at my conviction that we needed to undertake an historic rebalancing of how much of the annual share of responsibility is shouldered by the much smaller non-residential tax base, and so we shifted it from 51% to 48%. In the end, we arrived at a budget that I not only could support, but that I had to support - and it squeaked through on an 8-7 vote.

- Gian-Carlo Carra

Team Ward 9 has tried our best to simplify how these decisions came to be:

Decision 1: 2020 Budget and Service Levels

The fact is that our current city operating budget is not keeping pace with inflation and a growing city. Three options were on the table for a vote; a 3.03% increase, a 1.5% increase or a 0% increase. Cllr. Carra voted for, and Council approved, a 1.5% increase to our operating budget while increasing the amount collected from the taxpayer by 0%. This seemingly impossible scenario was achieved by using a one-time savings fund to make up the difference (our investment portfolio had a very good year and we reaped a one-time $8 0million payout that allowed us to make this move). Cllr. Carra voted to protect vital services and economic drivers for our city. These include “keeping whole” the Calgary Police Service, our Civic Partners, our Public Engagement and Communications, Calgary Art Development and Family and Community Support Services, the low income transit pass, and the Inglewood and Beltline pools. The use of one-time money means that over the next two years, Administration will continue to provide services while continuing to find additional efficiencies to avoid another tax increase or service cut conversation in 2023.

Decision 2: Tax Share

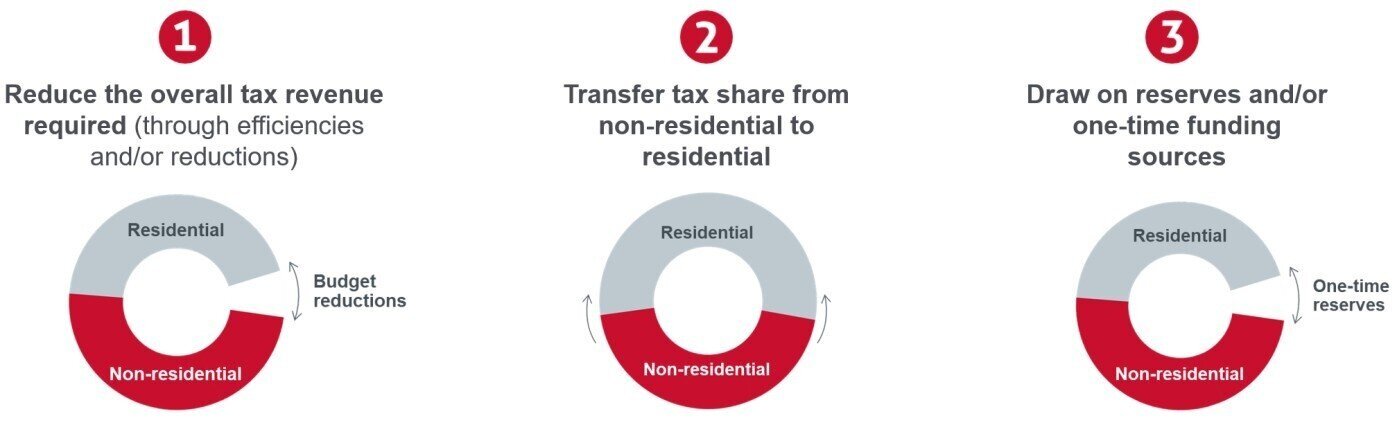

Council made a fundamental change to the way taxes are shared between residential (i.e. homeowners) and non-residential (i.e. businesses, commercial and industrial) tax payers from 49:51 per cent to 52:48 per cent residential to non-residential. With vacancies in the core, small businesses across the city were hit over the past four years with significant increases to their tax bill. We were able to provide multiple tax relief opportunities but these band-aid solutions didn’t address the fundamental problem; services to residences make up 80% of the city’s operating budget but carry less than half of the tax burden. This tax shift, is important for supporting our local economy, and brings us in line with other Canadian cities.

Monthly Total Property Taxes for a Typical Single Residential Home in 2020, City of Calgary

Distribution of municipal “taxes” between residential and non-residential taxpayer groups.

Decision 3: Provincial Off-Loading

The Provincial budget reduced funding to The City by $13M, largely to Calgary Police Services. They also eliminated cannabis revenue sharing. The province is also asking for $15M more money in property taxes, which the City is required to collect on their behalf. Council approved a flow through to taxpayers to cover the shortfall in our police budget to prevent a loss of services. This will appear on your tax bill as a separate line item but does not represent an increase in the City’s or Calgary Police Services operating budgets - this is the Province taxing Calgarians.

What this means for you:

As a result of these decisions, the typical single residential home will see a total increase to their property taxes of $12.50 per month ($1.14 per month as a result of provincial off-loading and $11.36 per month due to the shift in the tax share). These decisions by Council are extremely prudent and demonstrate a continued restraint on City spending while acknowledging the challenges faced by businesses. It’s important to note that despite growth and inflation, the City of Calgary continues to offer incredible value at a rate well below most jurisdictions across North America.

Thankfully, our long tradition for continuous improvement will help us to continue to modernize our services and help us realize further savings across the organization. As a city, we’ll be developing strategies and implementing initiatives to achieve target budget reductions of $24 million in 2021 and $50 million in 2022 while maintaining the low income senior’s transit subsidy, Family and Social Services and the Beltline and Inglewood pools. You can learn more about how these decisions are made and read further about property taxes here.

With the decisions made by Council, it is important to note that regrettably there will be staff impacts. Each department and business unit leaders will be working through the implications of Council’s decisions in the days and weeks ahead. More important to remember that there is also a human toll; much like the painful layoffs around the city in various sectors, job losses have far reaching negative consequences on families and community members in our city. City workers are workers that deserve dignity and respect as much as employees in the private sector. we regret the impacts these decisions will have on the incredible workers here at the City of Calgary. We, at Ward 9, fought and voted for the least harm approach to all Calgarians.

Capital Investments

We are acutely aware of the challenges Calgary is facing right now. A few years back, Council sought advice from mayors of other major cities who faced similar economic changes, including Pittsburg and Denver.

Unanimously, the advice was:

“don’t cut, build your city and make it a great place to live and the economy will correct itself. To turn things around it takes time, guts and commitment to the future.”

In the spirit of continuous improvement, they sought efficiencies and savings opportunities and in the past five years managed to save over $650M for this purpose. Council approved the four projects because investing in Calgary is exactly what Calgary needs. The Arena/Events Centre, the BMO Centre, and the Arts Commons redux will anchor the Downtown’s Cultural District, and the Field House will co-anchor an equally important district committed to excellence in sports and active lifestyles with McMahon Stadium and the University of Calgary. At a much larger city-shaping level, the Green Line will unlock mobility options for the North and South East as well as grow dozens of active and diverse neighbourhoods along its route. Councillor Carra challenges anyone to find an historical example where austerity and cuts have led to prosperity.

Breaking up the projects, as was motioned by some members of council, would ostensibly result in a lack of sufficient support for any one project and mean the breaking of commitment made by council in July. Calgarians are varied and dynamic in their views on what adds value to our city; but Cllr. Carra firmly believes that backing out of a deal, choosing favorites, or giving up on our future is exactly the kind of game-playing we’ve been prompted to do by the province and won’t get us where we want to go.

At the end of the day, were the money earmarked for these projects used to alleviate the shortfalls in our ongoing operating budget, we would be nowhere closer to a solution. Calgary, as a city, is not in decline and at a certain point our services and operating budget must grow to keep up with the demands of a growing population. Talking honestly about taxes isn’t easy but Cllr. Carra is not willing to participate in passing the buck or passing up the opportunity to help revitalize our economy and city.

It was so encouraging to hear from so many hard-working, everyday Calgarians thoughout this process. The ratio of “please don’t cut service and raise my taxes if necessary” to “austerity” in our inbox, voicemail and from public submissions to Council was 17:1. Thanks to everyone that reached out. Cllr. Carra hears you and has your back. There is more work ahead but we’re glad we were able to protect our most vulnerable, bring some relief to our business community and continue to drive towards our city’s best future.

Sincerely,

Team Ward 9